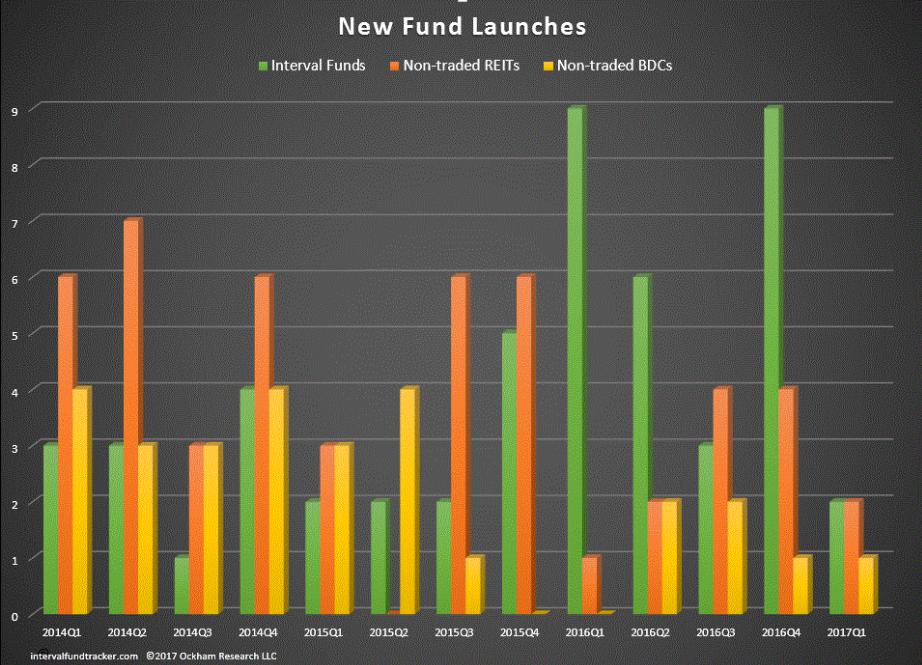

Launches of interval funds have overtaken non-traded REITS and BDCs (Source: SEC Filings)

Launches of interval funds have overtaken non-traded REITS and BDCs (Source: SEC Filings)

The market for retail alternative investments is in the midst of a dramatic secular shift. High commission non-traded REITs and BDCs were a core revenue source for many smaller broker-dealers. However sales have collapsed. Lightstone recently laid off most of its sales staff and closed its non-traded REITs. Lightstone will likely be launching Reg D and Reg A+ offerings. Inland has struggled to raise capital for its REIT although it continues to dominate the 1031 Exchange space, and is in the process of launching a private closed end fund. FS Investments and Griffin Capital have both diversified their product suites away from traditional retail alternative investments, into newer product structures designed to achieve the similar objectives.

Non-traded REITs and BDCs peaked right before the ARCP accounting scandal which ultimately led to the collapse of the Nick Schorsch empire. This led to many broker-dealers suspending sales from anything affiliated with then largest non-traded product Sponsor. Finra 15-02, which increased the transparency on client statements, made it harder for advisors to get away with charging the traditional 10% sales load. The looming fiduciary standard, which required broker-dealers to act in the best interest of clients, also led many broker-dealers to suspend or slow down the sales of high commission products.