On this day in 1940, President Roosevelt signed the Investment Company Act of 1940. Previously, both houses of congress had approved the ’40 Act unanimously. The ’40 Act, is the primary source of regulations for the multi-trillion dollar investment industry. The ’40 act defined and regulated investment companies, and provides investors with protections against conflicts of interest, misappropriation of funds, excessive fees, and undisclosed risks.

As he signed the bill, President Roosevelt declared:

We have come a long way since the bleak days of 1929…. I have great hopes that the act which I have signed today will enable the investment trust industry to fulfill its basic purpose as a vehicle to diversify the small investors risk.

What is a ’40 Act Fund?

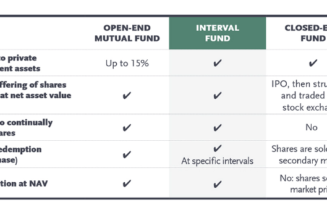

The investment companies that the 1940 Act protections apply to are known as 1940 Act Funds, or ’40 Act Funds Broadly speaking, there are three types of ’40 Act Funds: Closed End Funds, Open End Funds, and Unit Investment Trusts. Open end funds and closed end funds are the most common type of