Interval Fund Market Keeps Setting New Records

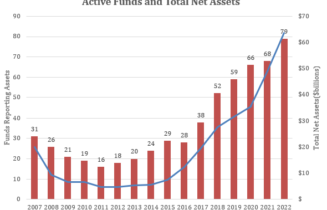

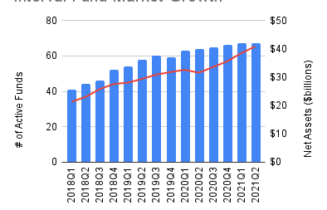

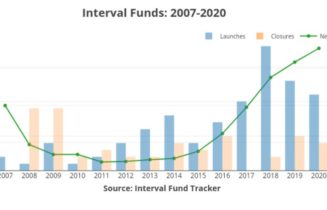

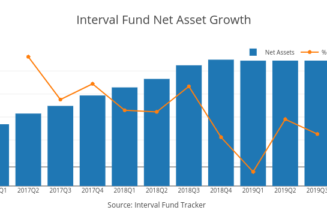

The interval fund sector set more growth records in 2022. At the end of 2022, interval fund net assets totaled $63.5 billion, up 29.8% compared to the end of 2021. There were 79 active funds with assets(1), compared to 68 at the end of 2021. Credit and Real Estate were the fastest growing interval fund […]