Institutional Investors Driving Interval Fund Growth

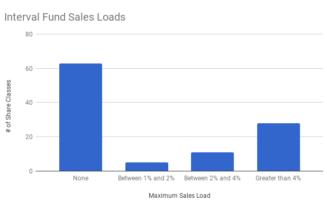

Interval funds are increasing in popularity among institutional investors and RIAs. One way to see this is to analyze the sales charge levels across available interval fund share classes:

(Premium members can view an interactive version of this chart, and download the underlying data)

The majority of available share classes currently in the market have no sales charge at all. Less than a third of actively distributed share classes have sales loads above 4%. Consequently, RIAs have been quicker to embrace interval funds than broker dealers.

Interval Fund Sales Charges and AUM

The story is even more extreme when you look at where interval funds assets are concentrated.

The largest interval funds are raising capital exclusively from institutional investors and RIAs. The three active Stone Ridge funds, which together account for 45% of interval fund net assets, do not have any sales charge. The two Versus Capital funds, which together account for 12% of net assets, also do not have any sales charge.

…