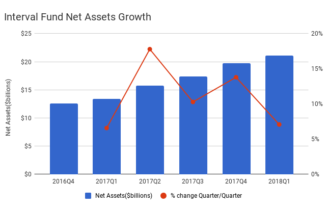

Interval fund AUM continues to grow. Total interval fund net assets equaled $21.2 billion as of the most recent public filings, up 58% compared to the prior year, and 7% compared to the prior quarter.

Interval fund AUM growth in recent months has been driven by increasing acceptance from institutional investors and fiduciary investment advisers. Most sales of new share classes have been without sales commission.

Fastest Growing Interval Funds

Thirty-two active interval funds reported net asset growth in the most recent quarter. The ten fastest growing interval funds accounted for over 90% of the quarterly increase in net assets for the entire niche. The following list shows the ten fastest growing interval funds, based on net asset growth in the most recent reported quarter

| Fund |

Date of Reporting Period |

Net Assets Increase MRQ |

| Versus Capital Real Assets Fund LLC |

December 31, 2017 |

$171,438,620 |

| Stone Ridge Trust V |

November 30, 2017 |

$170,501,396 |

| Griffin Institutional Access RE Fund |

December 31, 2017 |

$149,906,670 |

| Versus Cap Multi-Manager RE…LLC |

December 31, 2017 |

$149,235,268 |

| Stone Ridge Trust III |

October 31, 2017 |

$143,110,907 |

| ACAP Strategic Fund |

December 31, 2017 |

$139,268,922 |

| PIMCO Flexible Credit Income Fund |

December 31, 2017 |

$135,953,000 |

| Total Income (plus) RE Fund |

December 31, 2017 |

$79,030,078 |

| RiverNorth Marketplace Lending Corp |

December 31, 2017 |

$76,703,147 |

| Stone Ridge Trust II(Stone Ridge Reinsurance Risk Premium Interval Fund) |

October 31, 2017 |

$67,352,205 |

Catastrophe events in 2017 including hurricanes Harvey, Irma and Maria, as well as the California wildfires have impacted the insurance linked securities sector. Consequently, asset growth at the Stone Ridge funds slowed down in late 2017, but demand from new investors kept them among the fastest growing funds. Pioneer ILS Inverval fund did experience modest outflows, and the most recent NAV is 8% below the prior quarter Nonetheless, catastrophe bonds continue to be a popular asset class among institutional investors. Investment Manager Marco Pirondini, quoted in Barrons recently, emphasized reinsurance as a source of income not correlated with the broader capital markets. The insurance linked securiites sector accounts for 33% of total interval fund AUM.

Real estate strategies expanded rapidly in late 2017. Both of Versus Capital’s funds are rapidly expanding. Bluerock, which manages the Total Income (Plus) Real Estate Fund, has experienced increased fundraising across its entire platform. Likewise, Griffin Institutional Access Real Estate Fund is among the fastest growing funds, and recently crossed the $2 billion mark.

Pipeline of New Interval Funds

New fund registrations and launches continued at a robust pace in 2018Q1. This is the earliest leading indicator of future interval fund AUM growth.

New Fund Registrations

Four interval funds filed initial registration statements with the SEC in 2018Q1, each from experienced asset managers using the interval fund structure for the first time.

| Fund Name |

Registration Date |

Strategy |

| Cliffwater Direct Lending Fund |

2018-03-30 |

Credit |

| Flat Rock Opportunity Fund |

2018-02-20 |

Credit |

| American Beacon Sound Point Enhanced Income Fund |

2018-02-09 |

Credit |

| Weiss Strategic Interval Fund |

2018-02-01 |

|

Cliffwater Direct Lending Fund will focus on directly originated loans, using a multi-manager approach to allocate among multiple subadvisers. Cliffwater LLC will serve as the adviser. Cliffwater LLC is widely known for its research in the credit space. It created the Cliffwater Direct Lending Index, and the Cliffwater BDC Index.

Flat Rock Opportunity Fund will primarily invest in equity and junior debt tranches of CLOs. It may also invest in senior secured loans. Flat Rock Global, LLC advises the fund. Robert Grunewald founded Flat Rock in 2017. He previously ran Business Development Corporation of America and has worked with several asset managers and specialty finance firms. Flat Rock Global also advises Flat Rock Capital Corp, a newly launched non-traded BDC.

American Beacon Sound Point Enhanced Income Fund will invest in a variety of credit-related instruments. Targeted assets include corporate obligations and securitized and structured issues of varying maturities. American Beacon Advisers is the adviser, and Sound Point Capital Management LP is the sub-adviser. Sound Point has a total of $15.6 billion under management. It also subadvises InPoint, a newly launched non-traded mortgage REIT that is raising capital in the independent broker dealer and RIA space.

Weiss Strategic Interval Fund will maintain both long and short positions in a variety of equity securities. Targeted exposure is 130% long/30% short. Weiss Multi-Strategy Advisers LLC is the adviser. Weiss Multi-Strategy Advisers has a total of $1.4 billion in assets under management.

New Funds Declared Effective

…