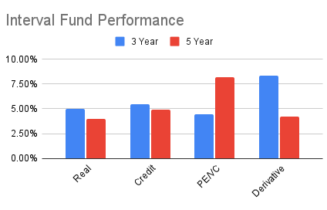

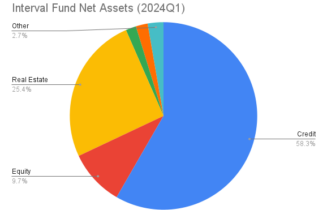

Top Performing Interval Funds

However beautiful the strategy, you should occasionally look at the results. Winston Churchill The interval fund sector has gone through unprecedented growth over the past few years. Yet there has been very little coverage of how these funds are actually performing, until now. In the article we provide a broad overview of interval fund performance, […]