Comparing BDCs and Interval Funds

With Financial Times coverage of closed end interval funds, and the recent growth in credit focused closed end funds, its a good time to compare the business development company structure to the closed end fund structure(including interval funds). Both provide investors with protections under the 1940 Act, and BDCs are also technically a type of closed end fund, but BDCs have several key differences in terms of fees, regulatory and filing requirements, and investment restrictions. These differences are important for investors, asset managers, and those involved in fund distribution.

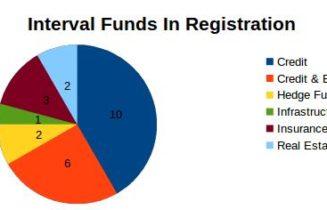

Here are interactive tables comparing BDCs and Closed End Interval Fund: