Real estate interval funds are an important option for investors looking for a liquidity compromise between publicly listed REITs and private funds. David Blatt of Capstack Partners wrote recently about the use of interval funds as a way of providing more investors access to direct real estate investing:

Recently, investment management firms have begun to take advantage of the interval fund to access retail capital for real estate investments. The attractive features of the interval fund that are more conducive to individual investors are the low required investment minimums, and the transparency afforded by SEC reporting requirements. But that’s not all. Real estate focused interval funds also offer exposure to a wide range of investments including listed, non-listed, public and nonpublic investments. Altogether, these features create a means by which retail investors and their financial advisors can access higher quality/higher return alternative investments in real estate.

When one considers the pace of evolution in the real estate investment industry, one can correlate the recent acceleration of new and repurposed investment vehicles to growing interest in the asset class – REITs gained popularity in 1990s, CMBS over the 2000s, private equity funds in the last decade, and more recently, growing retail investor interest in real estate that led to the interval fund. This evolution is a reminder that while real estate is generally a high priced, slow moving, fixed asset, the groups investing in real estate remain creative and resilient in the ways they structure the investments to access its rewards, while mitigating its risks. It makes for exciting times ahead for the space.

Institutional Real Estate

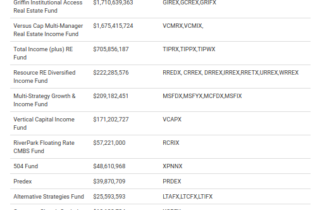

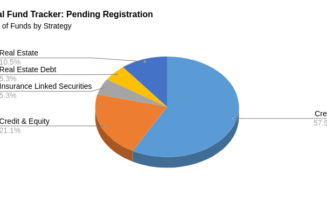

According to to Interval Fund Tracker’s data, 11 active interval funds with a combined total of $4.8 billion in assets focus on real estate. The three largest funds account for about 84% of the AUM in real estate interval funds, including Griffin Institutional Access Real Estate Fund, Versus Capital Multi-Manager Real Estate Income Fund, and BlueRock Total Income (Plus) RE Fund. Also note, that many diversified interval funds such as the Multi Strategy Growth and Income Fund and the Wildermuth Endowment Strategy Fund, focus on real estate as part of a broader asset allocation strategy.