Interval Fund Market: 2018Q2 Update

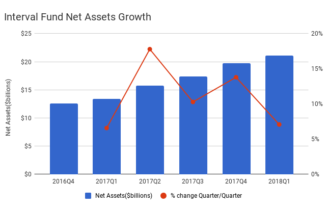

Interval Fund AUM growth continues apace. Total interval fund net assets equaled $23.3 billion as of the most recent public filings available at the end of 2018Q2, up 48% compared to the prior year, and 9% compared to the prior quarter.

Filings released subsequent to the end of the quarter increased the total net assets to over $24.9 billion.

Interval fund assets remain highly concentrated. Although there are over 50 active interval funds,the five largest alone account for approximately two-thirds of total net assets. The following table shows the ten largest funds by net assets based on data available as of July 13, 2018:

| Fund | Reporting Period | Net Assets MRQ* | % of total |

| Stone Ridge Trust II(Stone Ridge Reinsurance Risk Premium Interval Fund) | April 30 | $6,057,814,943 | 24.9% |

| Stone Ridge Trust V | February 28 | $3,166,896,731 | 13.0% |

| ACAP Strategic Fund | March 21 | $2,685,832,936 | 11.0% |

| Versus Cap Multi-Manager RE…LLC | March 31 | $2,184,487,819 | 8.8% |

| Griffin Institutional Access RE Fund | March 31 | $2,143,713,412 | 9.0% |

| Stone Ridge Trust III | April 30 | $1,548,580,667 | 6.4% |

| Total Income (plus) RE Fund | March 31 | $930,960,667 | 3.8% |

| Pioneer ILS Interval Fund | April 30 | 810230127 | 3.0% |

| Versus Capital Real Assets Fund LLC | March 31 | $802,733,509 | 3.3% |

| Invesco Senior Loan Fund | February 28 | $740,187,763 | 1.7% |

* July 8, Stone Ridge Trust II released a new filing indicating net assets have increased from $5.02 billion to $6.06 billion.

Fastest Growing Interval Funds

Twenty nine active interval funds reported net asset growth in the most recent quarter. Fourteen reported a decrease, and seven reported no change. The five fastest growing interval funds alone accounted for over 70% of the quarterly increase in net assets for the entire niche. Astute readers will notice substantial overlap between the lists of largest and fastest growing interval funds. The following list shows the ten fastest growing interval funds, based on net asset growth in the most recent reported quarter

| Fund | Date of Reporting Period | Net Assets Increase MRQ |

| Stone Ridge Trust II(Stone Ridge Reinsurance Risk Premium Interval Fund) | April 30 | $1,040,278,920 |

| ACAP Strategic Fund | March 31 | $275,233,158 |

| Stone Ridge Trust V | February 28 | $266,877,918 |

| Versus Capital Real Assets Fund LLC | March 31 | $238,077,084 |

| Versus Cap Multi-Manager RE…LLC | March 31 | $188,599,970 |

| Weiss Strategic Interval Fund | March 31 | $175,567,199 |

| PIMCO Flexible Credit Income Fund | March 31 | $147,093,000 |

| Pioneer ILS Interval Fund | April 30 | $133,811,479 |

| Griffin Institutional Access RE Fund | March 31 | $120,362,565 |

| Total Income (plus) RE Fund | March 31 | $65,535,061 |

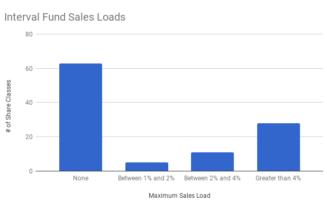

Fee structures are becoming more standardized, and several service providers have become critical to the interval fund ecosystem. For additional detailed information on fund structure trends in the interval fund space click here.

Pipeline of new funds

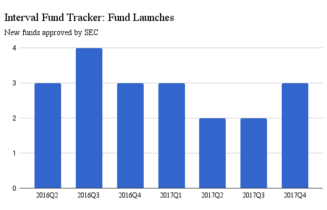

Growth of the interval fund pipeline accelerated in 2018Q2. Pace of fund registrations and launches is a strong leading indicator of future sector growth.

New Fund Registrations

Seven interval funds filed initial registration statements with the SEC in 2018Q2.

| Fund | Registration Date | Strategy |

| Oppenheimer ILS Interval Fund | 2018-06-13 | Insurance Linked Securities |

| American Beacon Apollo Total Return Fund | 2018-06-11 | Other |

| Hatteras Reinsurance Fund | 2018-05-15 | Insurance Linked Securities |

| City National Rochdale Strategic Credit Fund | 2018-05-14 | Credit |

| FS Multi-Alternative Income Fund | 2018-04-17 | Other |

| Variant Alternative Income Fund | 2018-04-13 | Credit |

| Savyon Trust Group, Inc. | 2018-04-10 | Credit |

Credit strategies, broadly defined, continue to be the most popular among fund managers getting ready to launch an interval fund.

New Funds Declared Effective

The SEC declared effective 5 interval fund registrations statements in 2018Q2. Additionally, one interval fund offering shares via a private offering started raising capital in 2018Q2. This is an acceleration in pace compared to prior quarters.

The public interval fund offerings declared effective in 2018Q2 are shown in the following table:

| Fund Name | Effective Date | Strategy | Maximum Offering Proceeds |

| American Beacon Sound Point Enhanced Income Fund | 2018-06-29 | Credit | $250,000,000 |

| NexPoint Latin American Opportunities Fund | 2018-06-25 | Credit & Equity | $100,000,000 |

| OFI Carlyle Global Private Credit Fund | 2018-05-31 | Credit | $1,000,000,000 |

| NexPoint Healthcare Opportunities Fund | 2018-05-10 | Credit & Equity | $100,000,000 |

| Destra International & Event Driven Credit Fund | 2018-05-09 | Credit | $126,000,000 |

(Note the Flat Rock Opportunity Fund also launched during the first week of the third quarter. It was declared effective on July 2)