Goldman Sachs Interval Fund Launch is a Precursor to Larger Alternatives Platform Expansion

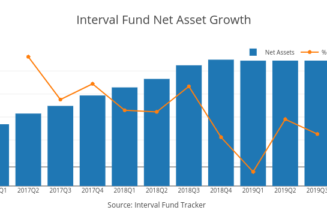

Goldman Sachs is in the midst of a strategic realignment to focus more on alternative investment strategies and retail investors. The new Goldman Sachs interval funds are a prime example of this new approach, and a precursor to a massive structural change in the retail alternative investments industry. Goldman started reporting Consumer and Wealth Management […]