Accordant Launches ODCEX Interval Fund

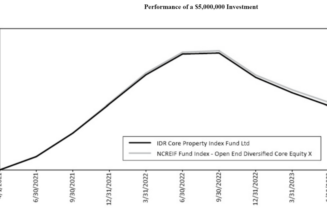

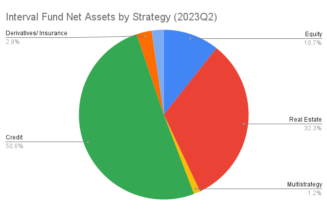

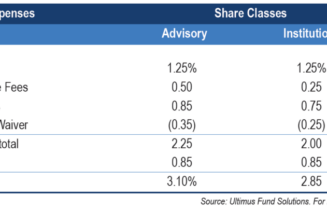

The Accordant ODCE Index Fund(ODCEX) is a new interval fund/REIT hybrid that launched in September. ODCEX was formerly known as the IDR Core Property Index Fund, and it launched in 2019 as a privately offered tender offer fund/REIT. In August, Shareholders approved the appointment of a new advisor and subadvisor. They also made several structural […]